Finnorth: A Complete Guide to Financial Education and Investing 2026

Navigating the world of finance can feel like wandering through a maze without a map. With countless terms, strategies, and platforms available, it’s easy to feel overwhelmed. This is where Finnorth steps in—a revolutionary platform designed to make financial education and investing accessible for everyone.

Whether you’re just starting out or looking to sharpen your financial skills, Finnorth equips you with the tools, insights, and guidance to confidently manage your finances and investments.

Introduction to Finnorth – A Platform for Financial Education and Investing

In today’s fast-moving financial landscape, making informed decisions is more crucial than ever. Finnorth provides a user-friendly platform that bridges the gap between complex financial concepts and practical investing skills. Its mission is to empower individuals of all experience levels with the knowledge and tools to succeed financially.

Finnorth offers a combination of educational content, interactive tools, personalized portfolios, and a thriving community of learners and investors. Whether your goal is to save for retirement, invest in stocks or ETFs, or simply gain confidence in money management, Finnorth helps you navigate every step with clarity and ease.

The Importance of Financial Literacy in Today’s Society

Financial literacy is essential for long-term financial health. Understanding personal finance, budgeting, and investment principles is no longer optional—it’s a necessity. Here’s why:

- Informed Decision-Making: Knowledge reduces errors in spending, saving, and investing.

- Long-Term Planning: Financial literacy helps individuals achieve life goals, from buying a home to funding education.

- Economic Contribution: Financially educated individuals contribute positively to the economy by making responsible spending and investment decisions.

- Risk Management: Understanding financial products helps mitigate potential risks and avoid debt traps.

In the digital age, where online transactions, cryptocurrencies, and investment apps are widespread, staying informed is critical. Finnorth addresses this need by providing accessible financial education for all.

How Finnorth Simplifies Financial Concepts for Beginners

One of Finnorth’s strongest features is its focus on beginners. It transforms complicated financial jargon into easy-to-understand lessons through:

- Bite-Sized Lessons: Short, targeted modules covering budgeting, saving, investing, and more.

- Interactive Tools: Calculators, charts, and quizzes allow users to experiment and learn practically.

- Real-World Examples: Lessons use practical scenarios to demonstrate concepts clearly.

- Community Engagement: Forums and discussion groups foster peer-to-peer learning and collaborative problem-solving.

By breaking down barriers, Finnorth makes finance approachable and empowers users to take their first confident steps in investing.

Features and Tools Offered by Finnorth for Investment Management

Finnorth offers an extensive suite of features designed for both novice and experienced investors:

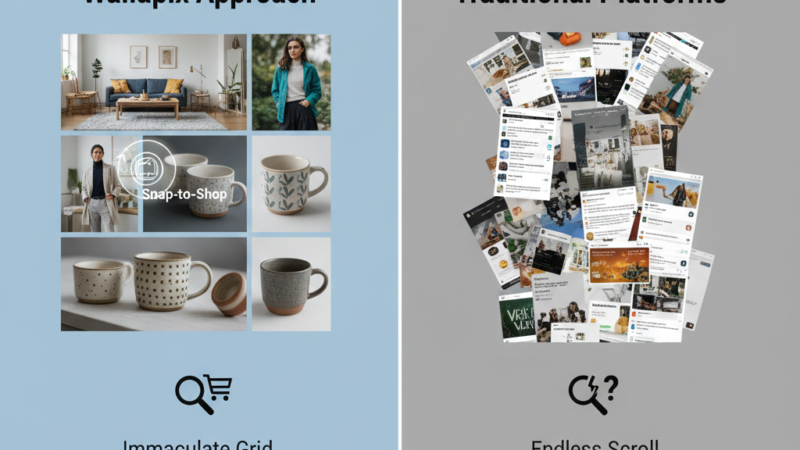

- Intuitive Dashboards: Visualize your entire portfolio and track performance in real-time.

- Personalized Portfolios: Tailor investments based on risk tolerance, goals, and preferences.

- Analytics and Insights: Track trends, evaluate asset performance, and make data-driven decisions.

- Educational Content: Access webinars, tutorials, and guides ranging from beginner to advanced topics.

- Community Forums: Connect with experienced investors, exchange ideas, and stay updated on market trends.

- Goal-Oriented Tools: Set savings and investment goals, with actionable steps to achieve them.

- Interactive Simulations: Practice investing in virtual environments to learn without financial risk.

These features ensure that learning finance and investing becomes a practical, hands-on experience rather than just theory.

Success Stories of Users Who Have Used Finnorth to Improve Their Finances

Many users have shared inspiring stories demonstrating how Finnorth transforms financial habits:

- Sarah: Started with no investing knowledge and was hesitant to start. Using Finnorth’s tutorials and tools, she made her first ETF investment and is now steadily growing her portfolio.

- Mark: Struggled with budgeting and expense tracking. Finnorth helped him create a sustainable budget, establish an emergency fund, and save for travel and personal projects.

- Jessica: Leveraged Finnorth’s analytics to monitor her retirement savings and diversify investments, reducing risk while improving returns.

These success stories show how the platform empowers individuals to take control of their financial futures, regardless of starting knowledge level.

Expert Advice and Tips from Top Investors on the Finnorth Platform

Finnorth also offers access to advice from seasoned investors. Key insights include:

- Diversification: Spread investments across multiple asset classes to minimize risk.

- Continuous Learning: Stay updated on market trends and new financial tools.

- Goal-Oriented Investing: Define short-term and long-term objectives to guide investment decisions.

- Emotional Discipline: Avoid panic during market fluctuations; stick to your strategy.

- Smart Risk Management: Balance high-risk and low-risk investments to maintain portfolio stability.

Engaging with these experts allows users to gain knowledge that can prevent costly mistakes and enhance long-term financial growth.

Additional Benefits of Using Finnorth

Beyond education and tools, Finnorth provides additional advantages:

- Accessibility: Designed for users at all knowledge levels.

- Time Efficiency: Bite-sized lessons allow learning at your own pace.

- Supportive Community: Access to mentors and like-minded peers for motivation and advice.

- Financial Confidence: Helps users make informed decisions without fear or uncertainty.

Tips for Maximizing Your Experience on Finnorth

To get the most out of Finnorth:

- Set clear financial goals and revisit them regularly.

- Engage with the community to gain new insights.

- Use interactive tools to simulate investments before committing real money.

- Follow expert webinars and tutorials to stay updated on best practices.

- Track your progress and adjust strategies using Finnorth’s analytics.

These steps ensure an active, meaningful, and results-driven experience.

Future Outlook of Finnorth in the World of Finance

As financial systems become more complex, the demand for accessible, digital financial education will continue to grow. Finnorth is well-positioned to adapt to emerging technologies like AI-driven investment insights, real-time analytics, and gamified learning environments.

Its community-based approach ensures that it evolves alongside user needs, making it a sustainable solution for financial literacy and investment management.

Conclusion: Empowering Individuals to Take Control of Their Finances with Finnorth

Finnorth is more than just a platform—it’s a partner in financial growth. By combining education, interactive tools, personalized portfolios, and community support, it empowers individuals to make informed decisions, manage investments confidently, and achieve long-term financial stability.

Whether you’re taking your first step into investing or seeking to optimize your financial strategies, Finnorth provides the guidance, support, and resources to succeed. With this platform, financial literacy is no longer intimidating—it’s empowering.

Frequently Asked Questions (FAQ)

Q1: What is Finnorth?

A1: Finnorth is a platform that provides financial education, investment management tools, and a supportive community for users of all experience levels.

Q2: Who can benefit from Finnorth?

A2: Anyone looking to improve financial literacy, manage budgets, or grow investments can benefit from the platform.

Q3: How beginner-friendly is Finnorth?

A3: Extremely. Finnorth offers bite-sized lessons, interactive tools, and a community for support and guidance.

Q4: Does Finnorth offer expert advice?

A4: Yes. The platform connects users with experienced investors who provide insights, tips, and strategies.

Q5: Why choose Finnorth?

A5: Finnorth combines education, practical tools, and a collaborative community to help users take control of their finances, make informed decisions, and achieve long-term financial goals.

One thought on “Finnorth: A Complete Guide to Financial Education and Investing 2026”